Unpacking The Buzz Around Glenda Mitchell Net Worth

It's almost natural, isn't it, to wonder about the financial standing of people you hear about? So, when the name Glenda Mitchell comes up, a lot of folks might find themselves curious about her net worth. This kind of curiosity is pretty common, especially in today's world where information feels like it's just a click away. People often want to get a sense of someone's financial journey, perhaps for inspiration or just to satisfy a simple question.

Yet, the reality of finding precise financial figures for private individuals, like a Glenda Mitchell, is that it's often quite a private matter. Financial details, you see, are typically not something that's openly shared unless someone is a very public figure, like a CEO of a large company or a well-known celebrity. For most people, their personal finances are kept, well, personal. This is just how things usually work, which is understandable.

Now, while we might not have a public record for every Glenda Mitchell out there, we can certainly look at what the name "Glenda" itself means and why people might be searching for such information. It’s a fascinating name, and its origins tell a bit of a story, too. We can also explore the general idea of net worth, what it truly means, and why it captures so much attention. It’s a topic that, in a way, goes beyond just one person.

- Indian Viral Mms.linkmaz

- 5movierulz 2024 Ndash Your Ultimate Guide To Downloading Telugu Movies.linkmaz

- Sone 436 Japan The Ultimate Guide To Discovering One Of Japans Hidden Gems.linkmaz

- Masa49com Masa49one Website Stats Insights.linkmaz

- Sarah Kellen Epstein.linkmaz

Table of Contents

- The Name Glenda: More Than Just a Label

- What Does "Net Worth" Actually Mean?

- Understanding Financial Privacy and Public Records

- Glenda Mitchell Net Worth: Addressing the Specific Query

- Common Questions About Personal Wealth

- Building Your Own Financial Picture

The Name Glenda: More Than Just a Label

The name Glenda, you know, carries a lovely sound and a rather interesting past. It's not just a collection of letters; it actually has some deep roots and a special meaning. For many, a name can tell you a little bit about where someone comes from or what qualities might be associated with them. It’s kind of neat to think about, really.

A Look at Its Origins and Meaning

The name Glenda is primarily a female name, and it has Welsh origins, which is pretty cool. Apparently, it comes from a combination of two Welsh words: 'glân', which means 'pure, clean, or holy', and 'da', which means 'good'. So, when you put those together, the name Glenda essentially means "holy and good" or "pure and good." It conveys a sense of purity, innocence, and cleanliness, which is a rather nice set of qualities for a name to suggest, isn't it?

Some also say it means "fair and good," which is very similar. There's another idea that it might be a feminine version of the name Glenn, using a suffix like those found in names such as Linda or Wanda. Glenn itself comes from Scottish Gaelic, meaning "valley." So, in some interpretations, Glenda could also mean "valley and good." It’s interesting how a single name can have a few different shades of meaning, depending on how you look at it. This variety just adds to its charm, really.

- Jameliz Benitez.linkmaz

- Gungun Gupta Viral Mms.linkmaz

- Dwayne Wayans A Comprehensive Look At His Life Career And Influence.linkmaz

- Movierulztc.linkmaz

- Unveiling The Truth Behind Buscar Kid And His Mom Video Original.linkmaz

Popularity and Historical Use

While the name Glenda has been around, it wasn't actually used regularly until the 20th century. It’s not one of those ancient names that you hear everywhere throughout history. This makes it a bit more modern in its widespread use. As for its standing today, Glenda is the 900th ranked female name by popularity. This means it’s not super common, but it's also not unheard of. It’s a name that many people recognize, but you probably won't find five Glendas in every room you walk into. It has a sort of unique feel to it, which some people might really appreciate.

A Glimpse at Glenda Wolff: A Name in the Real World

Sometimes, when you look up a name, you find real people who carry it. For instance, there's a Glenda Wolff who currently lives at 1350 Prairie Rose Dr, Sun Prairie, WI 53590. You can, apparently, check more contact information for her, too. There's also mention that a Glenda Wolff, possibly the same person, or maybe someone else with the same name, brings extensive knowledge and a compassionate approach to patient care. This just shows that people named Glenda are out there, living their lives and doing all sorts of interesting things. It’s a good reminder that names are carried by real individuals, each with their own story and their own contributions to the world. So, it's not just a name; it's a person, basically.

What Does "Net Worth" Actually Mean?

When people talk about "net worth," they're referring to a pretty simple idea, really, but it can get a little bit complicated when you start adding up all the bits and pieces. At its core, net worth is a way to measure a person's financial health at a specific point in time. It’s kind of like taking a snapshot of everything you own and everything you owe. This number gives you a quick summary of where you stand financially. It’s a very useful concept for individuals and even for businesses, too.

Assets Versus Liabilities

To figure out net worth, you need to know two main things: your assets and your liabilities. Assets are basically everything you own that has value. This could be your house, your car, money in your savings account, investments like stocks or bonds, even valuable jewelry or art. It’s anything that could, in theory, be turned into cash. On the other hand, liabilities are all the things you owe. This includes your mortgage, car loans, credit card debt, student loans, or any other money you've borrowed. So, to get your net worth, you simply take the total value of your assets and subtract the total value of your liabilities. The number you get is your net worth. It’s pretty straightforward, actually.

Why People Seek Net Worth Information

It’s very common for people to be curious about others' net worth, especially when it comes to well-known figures. There are a few reasons why this happens. Sometimes, it’s pure curiosity; people just like to know things. Other times, it's about inspiration; seeing someone else's financial success might motivate them to achieve their own goals. It can also be about comparison, even if that's not always the best thing to do. People might wonder how someone they admire has built their wealth or what kind of life that wealth allows them to live. It’s a topic that, you know, often sparks a lot of discussion and interest. It’s just how we are, basically.

The Challenges of Knowing Private Net Worth

Despite all the interest, figuring out the exact net worth of a private individual, like a Glenda Mitchell who isn't a public figure, is usually quite a challenge. Most people’s financial information is private, and for very good reason. Banks and financial institutions protect this data very carefully. Unless someone chooses to share their financial details, or they are required to by law because of a public role, that information just isn't available to the general public. So, any numbers you might see floating around for private individuals are often just estimates, and they might not be very accurate at all. It’s something to keep in mind, really, when you come across such figures.

Understanding Financial Privacy and Public Records

Financial privacy is a pretty big deal for most people. We generally expect that our bank balances, our investments, and our debts are kept secret. This expectation is usually protected by laws and by the policies of financial institutions. It’s a cornerstone of how our financial system works, actually. So, when you think about someone's net worth, it's important to remember that most of that information is simply not public, and that’s by design. It’s just how it is, you know.

Where Does Information Come From?

When you do see net worth figures reported, especially for very wealthy individuals, that information often comes from a few specific sources. For example, if someone owns a lot of shares in a publicly traded company, that information is usually public because of stock market rules. High-profile individuals, like politicians or top executives, might also have to disclose some of their financial holdings. Additionally, things like property records are public, so you can often see what real estate someone owns, though not necessarily how much they owe on it. But for the vast majority of people, their financial picture remains entirely private. It’s a very different situation for a private citizen compared to, say, a CEO of a big company. That’s just the reality of it.

The Ethical Side of Financial Inquiries

There's also an ethical side to wanting to know about someone else's money. While curiosity is natural, respecting people's privacy is really important. Just because you can look up some bits of information, like property records, doesn't mean you should try to piece together someone's entire financial life without their consent. It’s a bit like looking through someone's personal mail; it just isn't right. So, while we can talk generally about net worth, it's good to remember that specific figures for private individuals are usually off-limits, and that's a good thing for everyone's privacy. It’s a matter of respect, basically.

Glenda Mitchell Net Worth: Addressing the Specific Query

Given all we've talked about regarding financial privacy, it’s pretty clear that getting a precise figure for "Glenda Mitchell net worth" isn't something that's publicly available. There are, you know, likely many individuals named Glenda Mitchell in the world, and unless one of them is a very famous person who has publicly disclosed their finances, any number you might find online would just be a guess. It’s very important to understand that. We can’t just make up numbers or assume things about someone’s money. That wouldn't be accurate or fair, really.

The information we have about the name "Glenda" itself, as we discussed, tells us about its origins and meaning, and even mentions a "Glenda Wolff" in a public record context. But none of that information, you see, connects to a "Glenda Mitchell" or her specific financial standing. So, if you're looking for an exact dollar amount, it's simply not something that can be provided without access to private financial records, which we do not have and would not share even if we did. This is just how privacy works, and it’s a good thing for everyone involved. It’s really quite simple, when you think about it.

Common Questions About Personal Wealth

People often have questions about personal wealth in general, which is understandable. It’s a topic that touches everyone’s lives in some way. So, let’s explore a few common questions that come up when people think about net worth and financial standing. These questions are pretty typical, and they help us get a better handle on the whole concept. It’s good to have a clear idea, you know.

How is net worth usually calculated?

Calculating net worth is, in a way, pretty straightforward. You simply take the total value of everything you own, which are your assets, and then you subtract everything you owe, which are your liabilities. So, it's assets minus liabilities equals net worth. For instance, if you have a house worth $300,000, $50,000 in savings, and a car worth $20,000, your total assets would be $370,000. If you owe $200,000 on your mortgage and $10,000 on your car loan, your total liabilities are $210,000. Your net worth would then be $370,000 minus $210,000, which is $160,000. It’s a very basic formula, but it gives a pretty good picture of your financial position at that moment. You can learn more about personal finance basics on our site, actually.

Why are some people's net worth public and others not?

The main reason some people's net worth is public while most others' is private comes down to their role or profession. Public figures, like presidents, members of government, or CEOs of publicly traded companies, are often required by law to disclose their financial holdings. This is done for transparency, to prevent conflicts of interest, and to ensure public trust. For example, a company executive's stock holdings are public information, which is different from a private citizen's personal investments. For the average person, there's no such requirement, and their financial details are protected by privacy laws. It’s a system designed to balance public interest with individual rights, basically. It’s pretty sensible, too.

Can a person's net worth change quickly?

Yes, a person's net worth can absolutely change quite quickly, sometimes even dramatically. This happens for a lot of reasons. For example, if someone makes a very large investment that suddenly goes up in value, their net worth could increase a lot. On the other hand, a sudden job loss, a major medical expense, or a big drop in the stock market could cause a person's net worth to decrease rapidly. Major life events like buying a house (which adds an asset but also a large liability) or paying off a significant debt can also shift the numbers significantly. So, it’s not a fixed number; it’s more like a moving target that changes with life events and market conditions. It’s a very dynamic thing, really.

Building Your Own Financial Picture

Since we can't really get into the specifics of Glenda Mitchell's net worth, perhaps a more helpful approach is to think about your own financial picture. Understanding your own assets and liabilities is a powerful step towards feeling more in control of your money. It’s a very empowering thing to do, you know. Knowing where you stand can help you make better decisions for your future, which is pretty important for everyone, actually.

Tips for Tracking Your Assets

Keeping track of your assets doesn't have to be a big, scary task. You can start by making a simple list of everything you own that has value. This includes the money in your bank accounts, any investments you have, and the estimated value of things like your home, car, or other significant possessions. You could use a spreadsheet, a budgeting app, or even just a notebook. The key is to update it regularly, perhaps once a month or every few months. This way, you always have a pretty good idea of what you own. It’s a good habit to get into, basically.

Managing Your Liabilities

Just as important as knowing your assets is understanding your liabilities. List all your debts: credit card balances, student loans, car loans, your mortgage, and any other money you owe. Knowing these numbers helps you see where your money is going and where you might be able to make some changes. Prioritizing paying down high-interest debt, for example, can save you a lot of money over time. It’s about being smart with your money, you know. You can often find useful strategies for debt management, too.

Setting Financial Goals

Once you have a clearer picture of your assets and liabilities, you can start setting some financial goals. Do you want to save for a down payment on a house? Pay off a specific debt? Build an emergency fund? Having clear goals gives you something to work towards and makes managing your money feel more purposeful. It’s a very motivating thing, really, to have a target. For more detailed guidance, you might find our page on financial planning strategies quite helpful, too. As of today, November 19, 2023, taking these steps can really make a difference in your financial well-being.

- Hdhub4u Pro Your Ultimate Guide To Highquality Movie Downloads.linkmaz

- Sone 436 Video.linkmaz

- Movierulz5 Com.linkmaz

- Tyler Hynes Leaving Hallmark What You Need To Know.linkmaz

- 5 Movierulz 2025.linkmaz

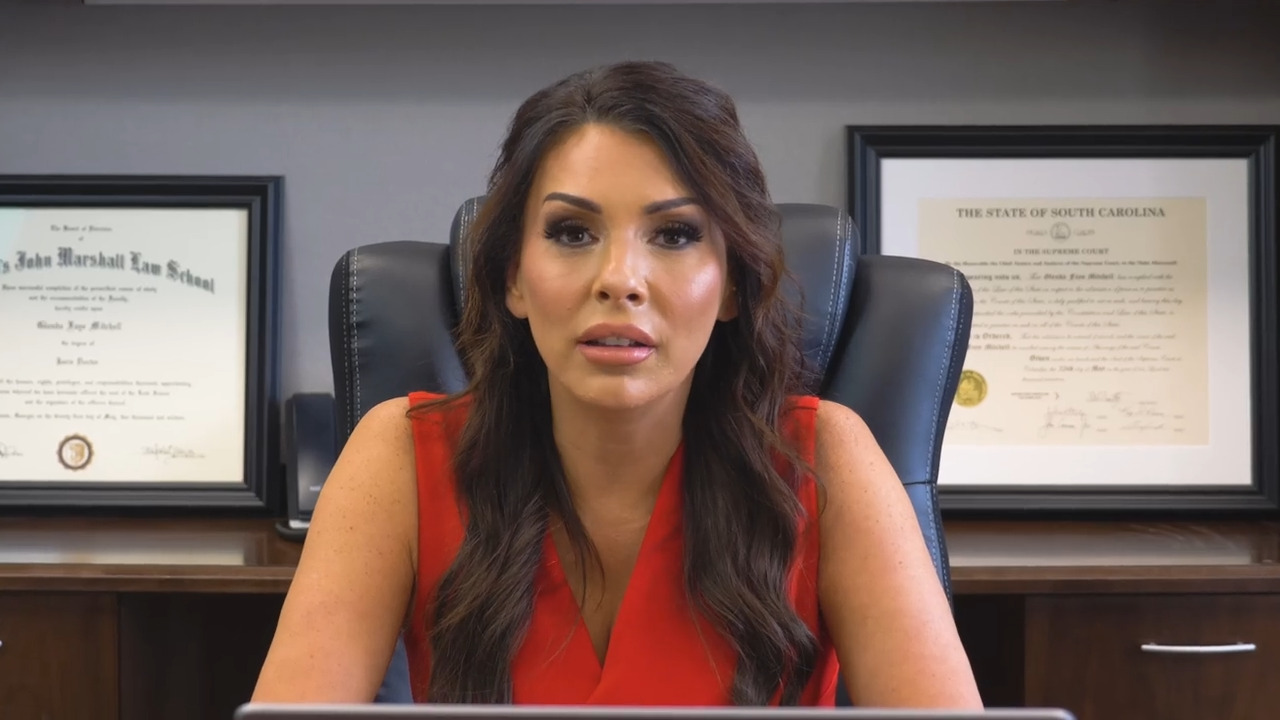

Glenda Mitchell Net Worth 2024 – Husband, Age, Height, Professional

Glenda Mitchell Net Worth 2025, Age, Height, Law Firm, Husband

Glenda Mitchell Net Worth 2023, Age, Bio, Wiki